Name of Issuer

National Electrical Annuity Plan (NEAP®)

Objectives and Goals of the Life Stage Funds:

Each of NEAP's five professionally designed and managed Life Stage Funds has an asset mix that's tailored for a specific age group - Under 30, 30s, 40s, 50s, and 60s Plus. The Life Stage Funds for younger age groups have a higher risk - higher return profile compared to Life Stage Funds for older age groups that are closer to retirement.

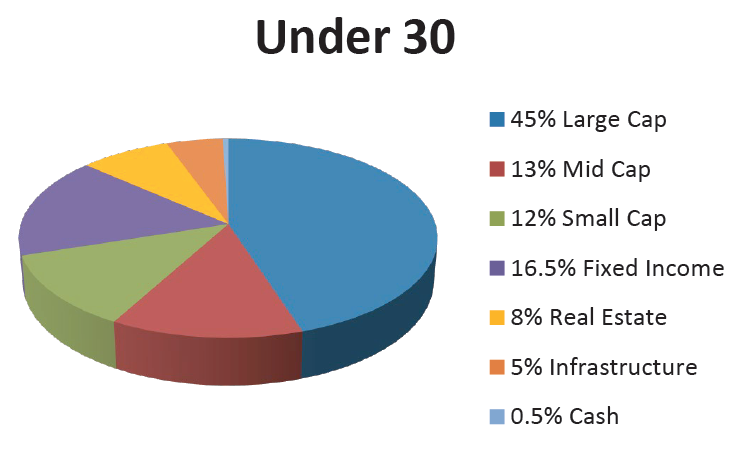

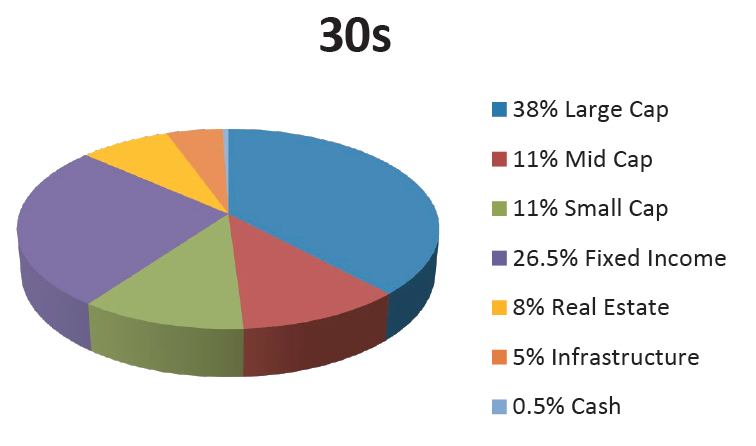

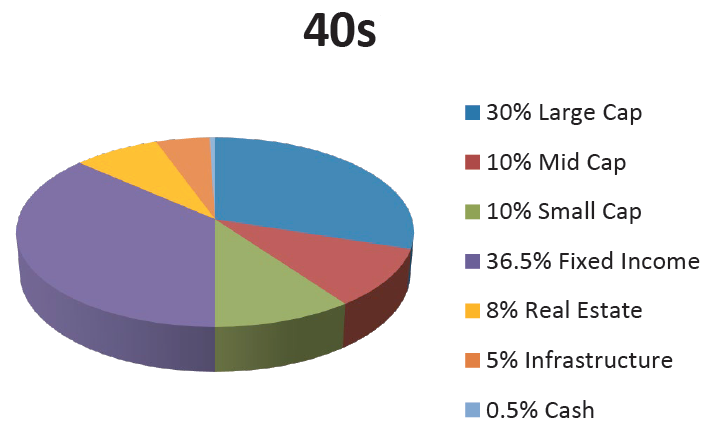

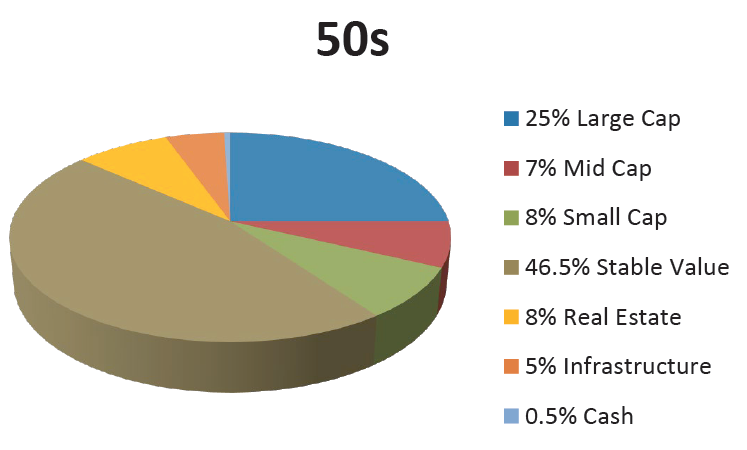

The target asset allocations for the various Life Stage Funds are summarized below.

Principal Investment Strategies of the Life Stage Funds:

Under 30 Life Stage Fund

The Under 30 Life Stage Fund is an aggressive, diversified investment portfolio designed primarily to provide growth opportunities for participants who likely will not retire for another 40 years. With approximately 70% of its assets invested in equities, the Under 30 Life Stage Fund is the most aggressive portfolio in the Life Stage program. It is designed for younger participants who, with a longer-term time horizon, can weather the short-term volatility typical of the equity (stock) markets, and reap the rewards of more aggressive investing which can be significant. Nonetheless, approximately 30% of the Under 30 Life Stage Fund is diversified in investments that are typically more stable, such as fixed income (bonds), real estate, and infrastructure, to help offset some of the volatility of the fund’s stock investments.

30s Life Stage Fund

The 30s Life Stage Fund is a fairly aggressive, diversified investment portfolio designed to provide growth opportunities for participants who have 30 or more years before they retire. With approximately 60% of its assets invested in equities, the 30s Life Stage Fund is oriented toward asset growth. While stock investments offer the potential for a greater investment return, they are also more volatile in the short term and are susceptible to market downturns. The investment mix of the 30s Life Stage Fund recognizes that participants in their 30s have a long-term time horizon, and typically can afford to weather the short-term volatility of the equity markets. Nonetheless, approximately 40% of the 30s Life Stage Fund is diversified in investments that are typically more stable, such as fixed income (bonds), real estate, and infrastructure, to help offset some of the volatility of the fund’s stock investments.

40s Life Stage Fund

The 40s Life Stage Fund is a moderately aggressive, diversified investment portfolio designed to provide both investment growth and stability. This fund is ideal for participants who have 20 or more years left before retirement. Approximately 50% of the 40s Life Stage Fund’s assets are invested in equities, which generally provide the opportunity for a greater investment return, but also are more volatile in the short term and are susceptible to downturns. To help defend against the volatility of the equity markets, approximately 50% of the 40s Life Stage Fund portfolio is diversified in investments that are typically more stable, such as fixed income (bonds), real estate, and infrastructure, to help offset some of the volatility of the fund’s stock investments.

50s Life Stage Fund

The 50s Life Stage Fund is a moderate-to-conservative, diversified investment portfolio designed to offer stability and asset preservation with opportunity for investment growth. This fund is ideal for participants who are nearing retirement, but have another ten years or so to work. Approximately 40% of this fund is invested in equities, which generally provide a greater investment return, though they are more volatile and are susceptible to downturns. To help defend against the volatility of the equity markets, approximately 47% of the 50s Life Stage Fund portfolio is invested in stable value assets with the aim of protecting principal while providing a steady and predictable rate of return. In addition, approximately 13% of the 50s Life Stage Fund is allocated to real estate and infrastructure to provide further diversification.

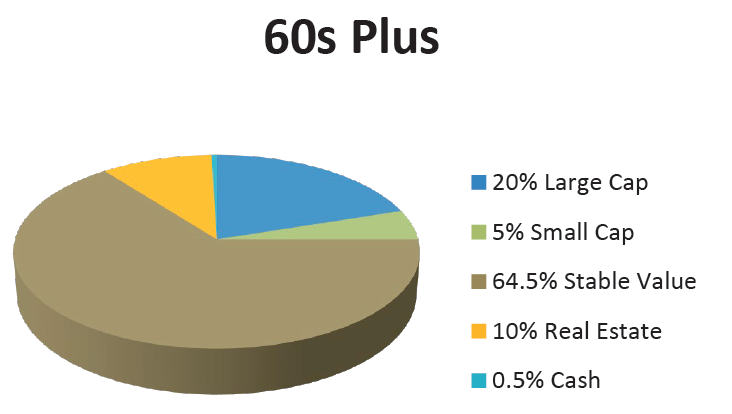

60s Plus Life Stage Fund

The 60s Plus Life Stage Fund is a conservative, diversified investment portfolio designed to preserve assets while providing a modest opportunity for growth. This fund is ideal for participants who are close to or in retirement. With approximately 65% of the fund invested in stable value assets, the 60s Plus Life Stage Fund is the most conservative portfolio in the Life Stage Program. Recognizing that growth potential is also still important as participants approach and move into their retirement years, approximately 25% of the fund is allocated to equity investments, which are more volatile and are susceptible to market downturns. The 60s Plus Life Stage Fund’s significant allocation to stable value assets is meant to defend against the volatility of the equity markets, while still providing a steady and predictable rate of return. In addition, approximately 10% of the 60s Plus Life Stage Fund is allocated to real estate to provide further diversification.

Principal Risks of the Life Stage Funds:

The value of the Life Stage Funds can go up and down substantially. The value of each Life Stage Fund may change because of broad changes in the markets in which that fund invests. The value of each Life Stage Fund may also change as a result of investment selection in the fund’s underlying asset classes or because of the fund’s asset allocation. There is no assurance that a Life Stage Fund will achieve its investment objective. These risks mean that your Life Stage Fund could lose money.

The following summarizes the main risks that the Life Stage Funds are subject to based upon the underlying mix of their investments. While each asset class has its own particular risk characteristics, the strategy of allocating the Life Stage Funds’ assets to different underlying asset classes and in varying proportions may allow those risks to be offset to some extent.

-

Main Risks of Investing in Underlying Asset Classes. Each asset class has its own set of investment risks, which can affect the value of a Life Stage Fund’s investments and therefore the value of your interest in that fund. If a Life Stage Fund invests more of its assets in one asset class than in another, it will have a greater exposure to the risks of that asset class. NEAP’s ability to achieve a Life Stage Fund’s objective will depend upon selecting the best asset allocation for that fund and there is a risk that the evaluations and assumptions regarding the fund’s mix of asset classes may be incorrect in view of actual market conditions.

-

Active Management Risk. The Life Stage Funds are subject to the risk that NEAP’s active investment managers’ judgments about the attractiveness, value, or potential appreciation of investments may prove to be incorrect.

-

Market Risk. The value of the securities in the underlying asset classes of a Life Stage Fund may be affected by changes in the securities markets. These markets may experience significant short-term volatility and drop sharply in value at times. Different markets may behave differently from each other.

-

Main Risks of Investing in Equity Securities. Stocks and other equity securities in the Life Stage Funds’ portfolios may fluctuate in price in response to changes in the equity markets in general, and may decline significantly over short time periods. There is a chance that stock prices overall will decline because stock markets tend to move in cycles, with periods of rising prices and falling prices. The value of a stock in which the fund invests may decline due to general weakness in the stock market or because of factors that affect a company or a particular industry.

-

Main Risks of Investing in Fixed-Income Securities. Fixed income securities in the Life Stage Funds’ portfolios may be subject to credit risk, interest rate risk, prepayment risk and extension risk. Economic and other market developments also may adversely affect fixed-income securities markets in which the Life State Funds invest.

-

Main Risks of Investing in Stable Value Securities. Investment in stable value securities involves a variety of risks including credit risk, liquidity risk and regulatory risks, as well as risks associated with the use of third party wrap contract issuers.

-

Main Risks of Investing in Real Estate. Investing in real estate entails the risks of the real estate industry generally, such as sensitivity to economic and business cycles, changes in property values, taxes, interest rates, occupancy rates, changing demographic patterns, potential liability under environmental and hazardous waste laws, and government actions.

Performance Data and Fee and Expense Information:

This section contains important information to help you compare the investment alternatives available in NEAP. It illustrates how these Life Stage Fund alternatives have performed over time and allows you to compare them with an appropriate benchmark for the same time periods. Please note that past performance does not guarantee how the investment alternative will perform in the future.

| |

AVERAGE ANNUAL TOTAL RETURN as of

12/31/2023 |

TOTAL ANNUAL OPERATING EXPENSES |

| LIFE STAGE FUND |

1 yr. |

5 yr. |

10 yr. |

Since

Inception |

As a % |

Per

$1,000 |

| LIFE STAGE FUND UNDER 30 |

14.53% |

10.64% |

8.51% |

7.99% |

0.24% |

$2.35 |

| |

|

| BENCHMARK |

15.51% |

11.21% |

9.02% |

8.27% |

|

|

| |

| LIFE STAGE FUND 30's |

12.76% |

9.35% |

7.63% |

7.42% |

0.24% |

$2.43 |

| |

|

| BENCHMARK |

13.73% |

9.88% |

8.11% |

7.66% |

|

|

| |

| LIFE STAGE FUND 40's |

10.96% |

8.04% |

6.72% |

6.84% |

0.25% |

$2.50 |

| |

|

| BENCHMARK |

11.87% |

8.50% |

7.16% |

7.02% |

|

|

| |

| LIFE STAGE FUND 50's |

8.32% |

7.47% |

6.00% |

5.86% |

0.23% |

$2.31 |

| |

|

| BENCHMARK |

9.05% |

7.81% |

6.41% |

6.15% |

|

|

| |

| LIFE STAGE FUND 60'S |

5.93% |

5.80% |

4.81% |

4.82% |

0.21% |

$2.12 |

| |

|

| BENCHMARK |

6.40% |

5.97% |

5.11% |

5.06% |

|

|

| |

Individual Fees

Individual fees may be associated with certain activities in your account. If you use a service or request a transaction listed below, the associated fee may be deducted from your account. Keep in mind that fees are subject to change and that certain individual fees may not be deducted in some circumstances.

Review of Qualified Domestic Relations Order (QDRO) - $200.00 per QDRO